Because data is hard to come by on active usage for top mobile apps, it’s hard to understand how wide a footprint the very highest-grossing games have. Plus, with a Renaissance in mid-core games over more casual titles during the past year, it’s often not the best-known or most widely popular games that perform the best financially. A small set of very loyal players can push a game to the top of the grossing charts, because they individually spend more than less committed players.

Onavo, a Sequoia-backed company that tracks active usage for millions of apps through its mobile data compression products, took at a look at the highest-grossing games. They wanted to see how much market penetration these games have compared to their rank on the top grossing charts. Just for background, Onavo has two products: Extend, which helps consumers save on their mobile bills by compressing data usage and Onavo Count, which tells you how much data you’re using.

Because they have single-digit millions of users, they can peek into daily mobile traffic to different apps. On top of that, because Onavo creates consumer-facing products and doesn’t work directly with developers, the company can publish data on active usage for specific apps. This is unlike other mobile analytics companies like Flurry, which can’t really disclose performance of specific apps because developers would probably not work with them.

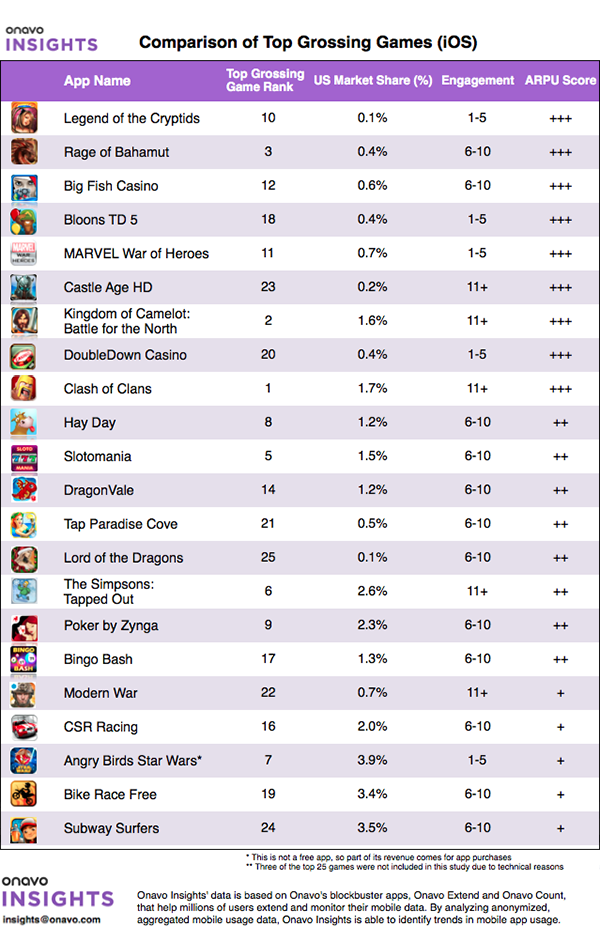

The company looked at game usage among their U.S. iPhone users in November. Then they looked at the market share, or the percentage of their U.S.-based iPhone owners that use these games on a monthly basis. So for example, in the chart, they found that Angry Birds Star Wars was being actively played by 3.9 percent of U.S. iPhone owners every month. Then they compared that to the game’s ranking on the grossing charts. From that, they tried to see roughly how strong average revenue per user (or ARPU) is for each title.

The most widely played games like Angry Birds Star Wars, Subway Surfers and Bike Race Free were not among the very, very top grossing games on a per user basis. More obscure (and often Japanese-made) titles seemed to do better. Legend of the Cryptids, a MMORPG from Applibot (which is a studio wholly-owned by the $1.4 billion Japanese company CyberAgent) did the best on a revenue-per user basis. The trading card game on DeNA’s Mobage network, Rage of Bahamut, came in second. Even though Onavo only picked it up on 0.4 percent of U.S. iPhones, it has simultaneously been ranked #1 grossing on both Google Play and the Apple app store in the past. It’s done so successfully that DeNA recently took a 20 percent stake in the game’s maker at a price that would value the developer at more than $400 million.

Following those two Japanese games was Big Fish Casino, a title that recently came out of the Seattle-based casual gaming company after it acquired Self Aware Games. Then there are several midcore games like Kabam’s Kingdoms of Camelot and Phoenix Age’s Castle Age that also have top-tier ARPU.

No comments:

Post a Comment